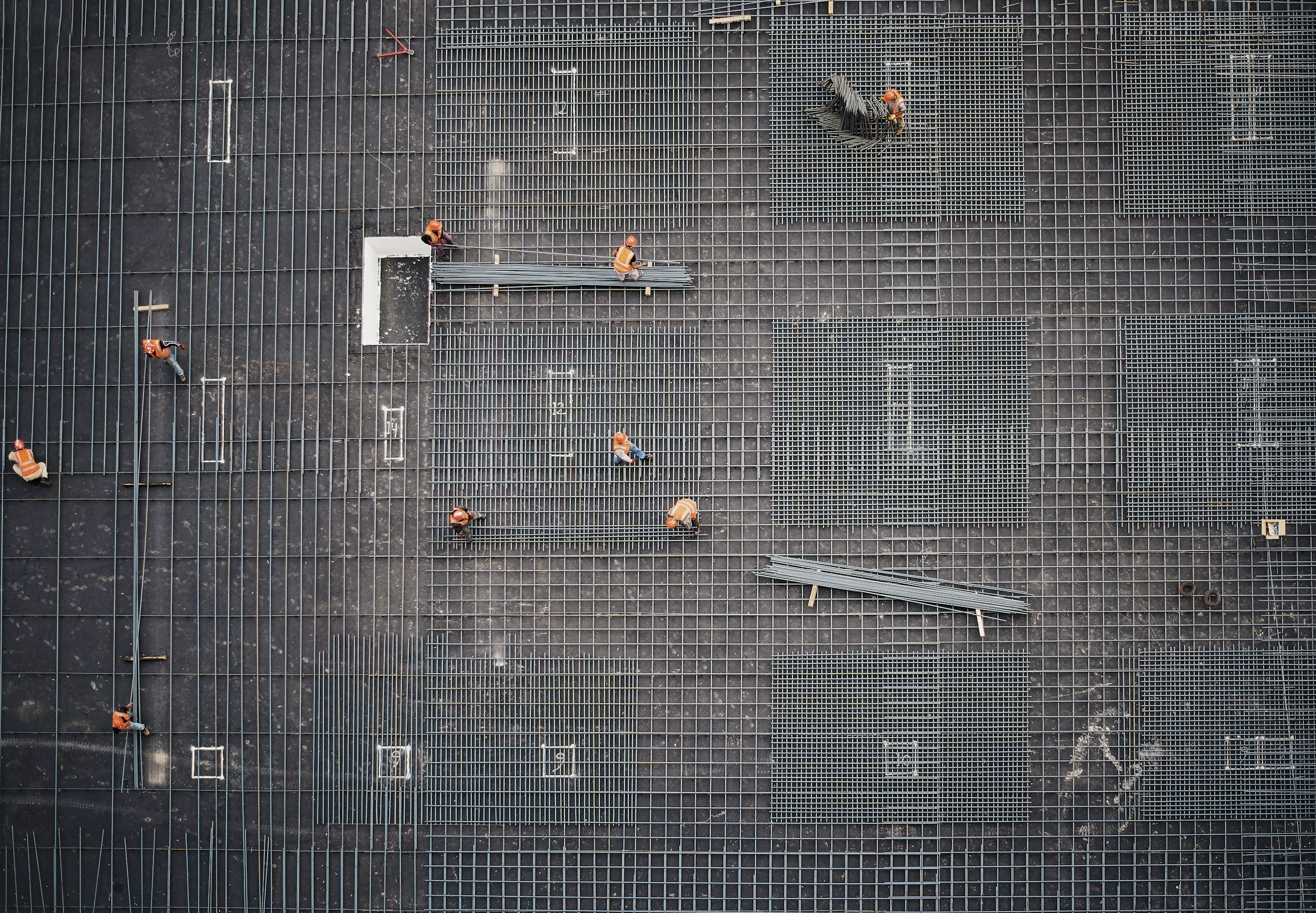

Construction Lending

Constructing Tomorrow, Financing Today.

Get building with our construction loans

Full Construction:

Ready to go vertical on either a scattered site or multi-phase construction project for either retention or resale? Or perhaps you have a commercial construction on the drawing boards. No matter the project type rates and terms can vary depending on location, size, type, and construction time.

The typical construction period is 12 and 18 months in most climates and typical terms are a margin of 2% to 4% over Wall Street Prime. Typically interest reserves are built into the loan eliminating the need for remembering to make monthly payments during the construction period.

If it is a resale rather than a retention project we understand the vital importance of the release clause as it addresses the amount of proceeds used to repay the construction loan and the amount retained by the developer. With years of extensive experience and expertise, we’re excited to discuss your project with you and can provide the most conducive terms in today's market.

Construction Completion:

For whatever reason a construction project has come to a stop, a construction completion loan can help resuscitate your project and get you across the finish line. We understand there are a multitude of moving parts but projects in this dilemma can certainly be funded.

Comprehensive Financing Options

With nearly five decades of experience, Addison Funding offers an unmatched range of financing solutions for all types of construction projects. Whether you're building residential homes, commercial properties, or large-scale developments, our extensive network of over a thousand financial institutions and private investors ensures we can craft a financing solution tailored to your project's unique needs.

Personalized, Professional Service

Our commitment to providing personalized, expedited service sets us apart. We understand the complexities and challenges of construction projects and work closely with you to ensure that your financing aligns perfectly with your goals. Our guarantee of terms in writing adds an extra layer of security and confidence to your build.

Versatile and Experienced Lending

Addison Funding's capability to fund a wide array of construction projects, from single-family homes to multi-unit developments, showcases our versatility and depth of experience. Our track record includes funding innovative and large-scale projects that others wouldn't consider. With us, your construction project isn't just another transaction; it's a partnership aimed at bringing your vision to life.

1K+

Access to over one thousand financial institutions, hedge funds, agency lenders, life companies, & private investment groups.

We finance any “makes-sense” scenario, finding creative routes to the most competitive terms. From subterranean fish farms to hospitality lending we’ve seen it all.

Personalized Care with a Commitment to Total Customer Satisfaction

Residential Purchase Construction Completion Loan customer

“They truly went above and beyond to help us secure funding”

“It was my absolute pleasure for me to provide details of my experience with Addison Funding a few years back. I can’t express enough how impressed I am with Addison Funding. They truly went above and beyond to help us secure funding for the purchase of two contiguous condominiums in Hollywood, California. Not only did they arrange a combination of a purchase and construction completion/renovation loan to seamlessly adjoin both properties, but they did so at exceptionally favorable terms.

From start to finish, their team was professional, knowledgeable, and incredibly responsive. They took the time to understand our unique needs and crafted a financing solution that perfectly fit our vision. The entire process was smooth and stress-free, thanks to their dedication and expertise.

We’re thrilled with the results and grateful for their outstanding service. I wholeheartedly recommend Addison Funding to anyone looking for a reliable partner in their real estate endeavors.”

-Jason M.